The latest presidential election campaigns are proving that very large segments of the population are disenchanted by behavior of both the right and the left, large political parties. One survey after the other carries the same message--most registered voters in this country believe that the political system is dysfunctional and corrupt, mostly due to campaign contributions and the quid-pro-quo enslavement of elected officials, repeatedly depending on donors' money to retain their seat.

A logical solution to avoid the entrenchment of money in politics--an idea that has been suggested many times in the past--is to establish public financing of election campaigns to level the playing field and limit the runaway cost of political campaigns. However, taking any step in this direction in the past, has been sabotaged and eventually blocked in Congress by the entrenched opposition of special interest groups with access to Big-Money. This opposition persists on both sides of the aisle.

Can individuals like us defeat Big-Money interests and change the system? This is an open question that was looked at by many people over the years. There is no single answer to this question. However, by looking at some of the ways in which individuals who believed in a common goal were able to get the attention of Big-Money and changed their behavior in past could give us a model to follow.

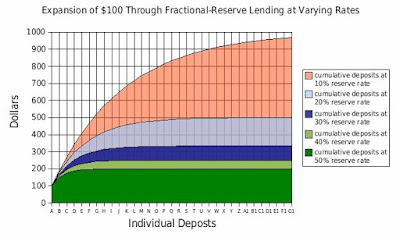

One of the extraordinary powers delegated to the banks in this country and around the world, depends on a mechanism that they have been gifted, to turn a single dollar into hundreds or even thousands of dollars. The key to this amazing financial popcorn machine is the savings account. If you ever wondered why every bank in your state is trying to lure you to open a savings account with them, the answer is simple. Banks use every single dollar in your savings account, to claim credit from the Central Bank. In the U.S. the central bank is the Federal Reserve Bank (FRB). Depending on their risk factor, as established by the Central Bank, each bank receives a credit that allows them to loan out, or finance, a proportional amount of debt, based upon the amount of dollars that you and people like you keep in their savings accounts. The ratio of dollars kept in these savings accounts to dollars loaned out can be 1:100, 1:1000 and much greater. This means that every single dollar that you keep in your savings account is extremely leveraged (see: Money creation).

|

| (Click on image to enlarge) |

Nowadays that we receive only "peanut dust" of interest income on our hard earned money and the stock market is moving sideways, wouldn't it be nice to get some value added benefit for our cash?

Imagine that you are going to empty your savings account. What does it mean to the bank? Perhaps not much, if a single person does it every once in a while. However, imagine that 100 or maybe 10,000 people are emptying their accounts at the same bank. This affects the amount of Currency that the bank holds in its reserves. The amount of Currency that the bank holds at any given time, is determining (among other factors) the bank's ability to issue new money in terms of new debt obligations. When you withdraw money from your savings or investment account, your heavily leveraged money is working in reverse--If many people do that simultaneously, the bank liquidity factor becomes at risk, because unless the bank can recall its issued loans and convert collateral to cash in a short time, the bank will default or at least will face a major investment restructuring. This is unlikely to happen in a broad manner, unless the public "runs on the bank", as happened in 1929 (see: https://en.wikipedia.org/wiki/Bank_run). However, for each individual banking institution, the risk of savings or investment accounts being emptied due to public sentiment and the funds moving to a competitor's coffers, the risk is very significant.

Of course inducing banks to default may not be good for the economy in the long run; however, if individuals with savings or investment accounts in specific banks want to send a powerful message to the Bank Board of Directors, they can use a policy of what Teddy Roosevelt referred to as "Speak Softly and Carry a Big Stick". In this case, make a symbolic withdrawal out of your savings account, followed by a message to the board, implying that you intend to withdraw all the money in your account and transfer the proceeds to another bank, because the bank invests in companies or interests that you are objecting to. To demonstrate to the financial institute management that you are not operating alone in this game, perhaps you and 150 other people would withdraw the exact sum of $1776.00 on the same day. If 15,000 people are collaborating in such a move, it is very likely that an alarm bell will be ringing in at the bank's headquarters. This kind of communication technique applies to investment banks, trust funds and company stock. Your leveraged money, is your power and if you work in concert with a group of people who share a common goal, the implied threat of disinvestment becomes a powerful tool.

A case in point proving the financial power of the public is the success that the disinvestment movement had on changing the regime in South Africa during the 1970's. Other examples involve movement by environmentally conciseness groups to affect the activities of oil companies. The disinvestment movement is typically associated more with the political left than the right; however, there is no real reason for this distinction. Voting with your money is available to all of us. It is a fundamental and effective action that can be materialized by any grass-roots movement.

Don't miss your opportunity to vote with your money, where one person can have more than one vote... :)

--Dr. Flywheel

Related links:

Wikipedia - Money Creation

Money creation in the modern economy

An oilman’s $7 billion refresher course in the economics of drilling and climate change

No comments :

Post a Comment