The only exception in the developed world in its approach to healthcare is the United States. Interestingly, life expectancy of the U.S. population is the lowest (31st. place) in the developed world, according to the latest World Health Organization survey (see: https://en.wikipedia.org/wiki/List_of_countries_by_life_expectancy). Further, a recent articles published in the Wall Street Journal claims that life expectancy for certain groups of the U.S. population is on the decline (see: Life Expectancy for White Americans Declines).

Unfortunately, the closest effort to controlling runaway medical costs, while serving the population healthcare needs, has been the Affordable Care Act (ACA), otherwise known as "Obama Care". Since the U.S. spends more than any other developed nation in the world on healthcare (17.3% of GDP in 2014) there is big money to be gained (or lost). Since these costs are expected to increase dramatically, as the Baby Boomer population is entering retirement age, congress must deal with cost controls or face bankrupting the U.S. economy in the next decade. Interestingly, Canada with its single-payer healthcare system is managing to spend almost half as much as the U.S., while maintaining a 12th place in population life expectancy vs. the U.S., which is in 31st place.

|

| (Click on image to enlarge) |

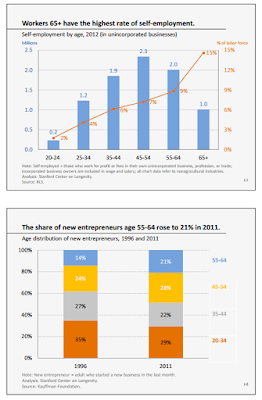

In spite of poisonous rhetoric that was frequently blasted by politicians during the last U.S. elections cycle, Government sponsored medical insurance coverage seems to be more popular than ever before, even at its currently less than perfect form. It is becoming clear that as the number of self-employed individuals who are too young to be covered for medical insurance under Medicare, is increasing, popularity of the Health Exchange is rising. Such individuals are not covered through a large employer risk pool and therefore are forced to pay the very high premiums that most insurance companies charge for their individual coverage plans. Demographic studies show that the "freelance" (self-employed) segment of the U.S. domestic workforce, is rapidly rising and is constantly being under-served. With the expectation of rising automation in the workplace, due to Robotics and Artificial Intelligence the number of workers joining the ranks of the self-employed will balloon over the next 10 years. What will Congress do to deal with this population?

A recent New York Times article covers the issues associated with the rising popularity of the Health Exchange. The article is entitled: Health Exchange Enrollment Jumps, Even as G.O.P. Pledges Repeal.

To quote the article:

About 6.4 million people have signed up for health insurance next year under the Affordable Care Act, the Obama administration said Wednesday, as people rushed to purchase plans regardless of Republican promises that the law will be repealed within months.

The 6.4 million number represents an increase of 400,000 over a similar point last year. This data may contradict the notion of a "popular national mandate" to dismantle the Affordable Care Act , in favor of a GOP replacement plan. The increase in popularity of ACA medical insurance, facilitated through the Health Exchange, becomes even more interesting in view of almost across the board 2017 premium rate hikes that were imposed by most medical insurance providers, throughout the Nation.

In another NY Times article, ROBERT H. FRANK who is an economics professor at the Johnson Graduate School of Management at Cornell University covers the reality associated with too much political meddling with the current working model of Obama-care. you can read all about it at the following link:

Want to Get Rid of Obamacare? Be Careful What You Wish For.

It is clear that the two dominant parties are going to fight over the implementation of healthcare policies. At 17.5% of the current GDP, there is too much money in this basket for any lobbyist to ignore. Will the new administration and the GOP controlled Congress and Senate be able to implement a solution that will serve our national needs, the needs of the people? Is there truly a reasonable solution, other than a single-payer system that can fix the system?

|

| (Click on image to enlarge) |

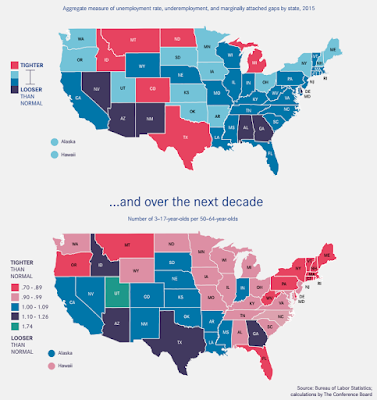

I highly recommend looking at the National Chart-book of Health Care Prices, published in 2016 by the Healthcare Cost Institute. The report shows the distribution across all individual states for specific medical treatment. This is a perfect example of "one nation divided under GOP"...

References:

- National Chartbook of Health Care Prices

- World Bank - Healthcare Expenditure Statistics

- By 2024, health spending will be nearly a fifth of the economy

Your comments are welcome. Please share with your friends and relatives, by clicking on the icon(s) of your favorite social network.

All the best and happy holidays!

--Dr. Flywheel